Warren Buffett’s recent decision to sell 10 million shares of Apple in the fourth quarter of 2023 has caught attention. Yet, it might not indicate a significant shift in his overall investment strategy. Despite the sale, Apple remains the largest holding in Berkshire Hathaway’s portfolio, underscoring Buffett’s ongoing confidence in the company. Just months prior, he lauded Apple as “a better business than any we own.”

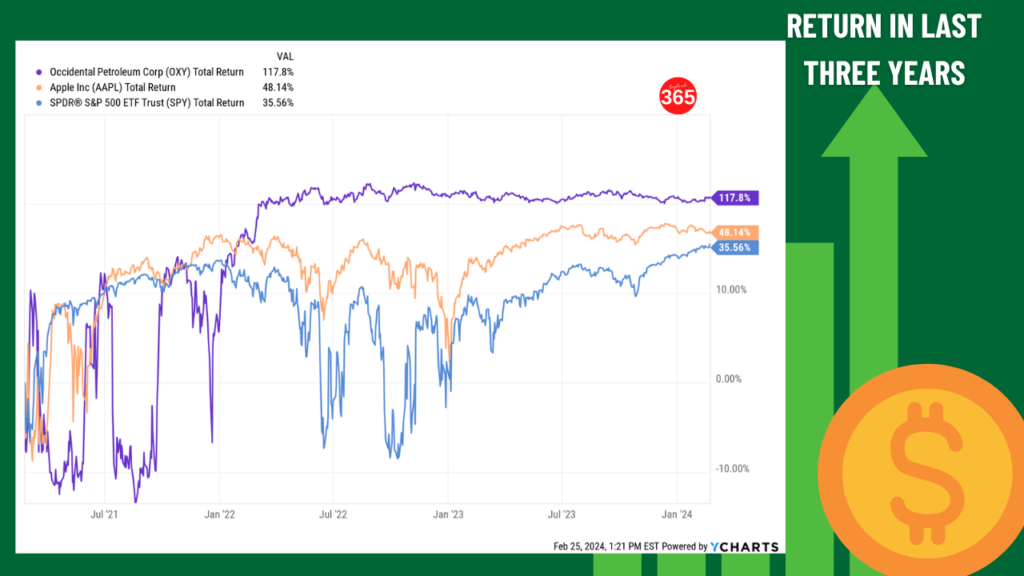

Buffett’s investment in Apple has indeed been astute, witnessing the tech giant’s market cap soaring by close to $2.2 trillion since the acquisition of his initial shares in the first quarter of 2016. However, Buffett’s latest move unveils a bold new investment strategy that could rival his successes with Apple. Buffett is aggressively acquiring shares of Occidental Petroleum (OXY) in a notable departure from conventional wisdom. Contrary to prevailing beliefs about fossil fuel decline in favor of renewables, Buffett maintains a bullish outlook on oil, foreseeing either stable or increasing production over the next five years.

Berkshire’s stake in Occidental Petroleum now stands at close to $14.9 billion, ranking it the sixth largest in its portfolio. This investment, centered on Occidental’s emphasis on direct air capture (DAC) technology, represents a calculated gamble with promising odds. With the acquisition of Carbon Engineering and the construction of the Stratos plant, Occidental positions itself at the forefront of carbon capture technology.

Buffett’s confidence in Occidental’s CEO, Vicki Hollub, and her strategic vision for the company are evident. Praising her leadership and understanding of the oil industry and political landscape, Buffett’s continued acquisition of Occidental stock reflects his faith in its potential. While his affinity for Occidental may never surpass that of Apple, this investment could mark Buffett’s most strategic move since his initial investment in the tech giant eight years ago.

Highlights

- Warren Buffett’s decision to acquire shares of Occidental Petroleum signifies a departure from prevailing market sentiments surrounding fossil fuels and renewable energy.

- Occidental Petroleum’s strategic focus on direct air capture (DAC) technology positions it uniquely within the evolving energy landscape.

- Through the acquisition of Carbon Engineering and the development of the Stratos plant, Occidental emerges as a significant player in carbon capture technology.

- Buffett’s endorsement of Occidental CEO Vicki Hollub underscores his confidence in her leadership and the company’s strategic trajectory.

- Berkshire Hathaway’s expanding stake in Occidental Petroleum reflects Buffett’s conviction in the company’s potential for sustained long-term growth.

- While not overshadowing his appreciation for Apple, Buffett’s investment in Occidental represents a deliberate and promising move within the energy sector.

Comparison Between Apple Stock and Occidental: Assessing Investment Dynamics

| Metric | Apple (AAPL) | Occidental Petroleum (OXY) | Interpretation |

|---|---|---|---|

| Market Cap | Approx. $2.2 trillion | Approx. $14.9 billion | Apple’s market cap significantly exceeds Occidental Petroleum’s, indicating its larger presence and valuation in the stock market. |

| Revenue (FY 2023) | Approx. $365.8 billion | Approx. $15.1 billion | Apple’s revenue far surpasses Occidental Petroleum’s, underscoring its stronger financial performance. |

| Net Income (FY 2023) | Approx. $100.3 billion | Approx. -$3.1 billion | Apple’s positive net income contrasts with Occidental Petroleum’s negative net income, reflecting their financial disparities. |

| EPS (Earnings Per Share) | $5.75 | -$3.77 | Apple’s positive EPS contrasts with Occidental Petroleum’s negative EPS, highlighting their differing profitability situations. |

| Dividend Yield | Approx. 0.6% | Approx. 0.5% | Apple’s slightly higher dividend yield reflects its shareholder return policy compared to Occidental Petroleum. |

| P/E Ratio (Price/Earnings) | Approx. 27.9 | Not Applicable (Negative Earnings) | Apple’s positive P/E ratio indicates investor confidence, while Occidental Petroleum’s negative earnings make it irrelevant. |

| Debt-to-Equity Ratio | Approx. 0.74 | Approx. 2.05 | Apple’s lower debt-to-equity ratio suggests better financial health compared to Occidental Petroleum. |

| Cash Holdings | Approx. $190 billion | Approx. $2.3 billion | Apple’s significantly higher cash reserves indicate greater financial flexibility than Occidental Petroleum. |

| Industry | Technology | Energy (Oil and Gas) | Apple operates in the technology sector, while Occidental Petroleum operates in the energy sector, reflecting diverse industry focuses. |

| Investment Duration | Since Q1 2016 | Recent Acquisition (Post-2023) | Apple’s long-term investment contrasts with Occidental Petroleum’s recent acquisition, showing differences in investment strategies. |

| CEO | Tim Cook | Vicki Hollub | Tim Cook leads Apple, while Vicki Hollub leads Occidental Petroleum, influencing their corporate strategies. |

| Focus | Consumer Electronics | Oil and Gas Exploration | Apple focuses on consumer electronics, while Occidental Petroleum focuses on oil and gas exploration, reflecting their core business areas. |

| Growth | Steady Growth | Apple focuses on consumer electronics, while Occidental Petroleum focuses on oil and gas exploration, reflecting its core business areas. | Apple’s steady growth contrasts with Occidental Petroleum’s volatile growth, reflecting industry dynamics. |

| Innovation | High emphasis on innovation | Focus on Oil Exploration | Apple prioritizes innovation, while Occidental Petroleum focuses on oil exploration, highlighting their differing business priorities. |

| Future Prospects | Continues to innovate | Betting on Direct Air Capture (DAC) | Apple continues to innovate, while Occidental Petroleum explores Direct Air Capture (DAC) technology to address carbon emissions. |

| Carbon Emissions Focus | Limited | Emphasizing DAC Technology | Apple’s limited focus on carbon emissions contrasts with Occidental Petroleum’s emphasis on DAC technology to mitigate environmental impacts. |

Conclusion

Analyzing Apple stock alongside Occidental highlights different investment strategies and market trends. Warren Buffett’s move towards Occidental, with an acquisition of $14.9 billion worth of shares, signals a shift in traditional perceptions about fossil fuels and renewables, emphasizing Occidental’s focus on innovative DAC technology and its potential in the energy sector. Occidental’s strategic acquisitions, including the recent purchase of Carbon Engineering for $1.1 billion, and progress in carbon capture technology, further reinforce Buffett’s confidence in its future growth. Meanwhile, Apple maintains its strong market presence, boasting a market capitalization of approximately $2.2 trillion and a revenue of $365.8 billion in FY 2023, along with its well-known reputation for innovation. This comparison underscores the complexity investors encounter when weighing established giants like Apple against emerging prospects like Occidental within a continuously evolving industry landscape.

Analyzed and written by:

Alexander Han

The author of this article does not hold any positions in the stocks discussed herein.

Disclaimer: The content provided in the above articles is intended for educational and informational purposes only. It does not constitute financial, investment, or professional advice, and should not be construed as such. The opinions expressed in the articles are based on hypothetical scenarios and the interpretation of events, and should not be taken as recommendations to buy, sell, or hold any securities or make any investment decisions.

Readers should conduct their research and seek the advice of qualified professionals before making any investment or financial decisions. The information presented may not be current or accurate, and it is subject to change without notice. The articles do not consider individual investment objectives, financial situations, or risk tolerances, and any reliance on the content is at the reader’s own risk.

The mention of specific companies, investments, or strategies is not an endorsement or recommendation. Past performance is not indicative of future results, and there is no guarantee of success or profit from any investment. The articles are not intended to create a client relationship between the reader and any individuals or organizations mentioned.

All investments involve risk, including the potential loss of principal. The authors and publishers of the articles disclaim any liability for any direct or consequential loss or damage arising from the use or reliance on the information provided. Readers are encouraged to thoroughly evaluate their financial situation and consult with a qualified advisor before making any investment decisions.